Project Info

Category

Date

Nigeria’s 5% Fuel Surcharge: Unpacking the Viral Claim and the Real Story

Introduction

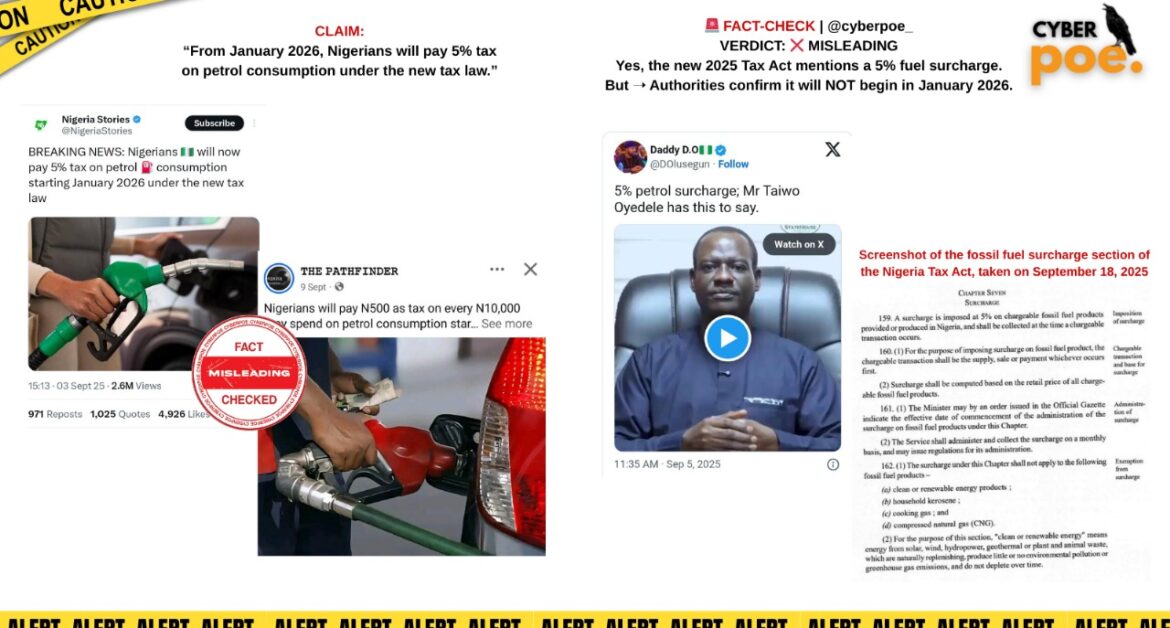

In September 2025, social media across Nigeria and beyond lit up with alarming posts. Viral claims insisted that beginning in January 2026, Nigerians would be forced to pay a new 5% tax on petrol consumption as part of sweeping reforms under the newly signed 2025 Nigerian Tax Act. The rumor spread quickly across X, WhatsApp, Facebook, TikTok, and Instagram, amplified by influencers, economic commentators, and even some local blogs. Against the backdrop of inflation, subsidy removals, and public frustration with rising fuel costs, the claim was fertile ground for outrage. But while the story contained a kernel of truth, it was fundamentally misleading.

Careful examination of the new legislation, along with statements from government officials and independent verification, reveals that while a 5% surcharge on fossil fuels does exist in law, it is neither new nor slated to begin in January 2026. This fact-check untangles the confusion, clarifies the legal context, and explains why this particular disinformation spread so quickly.

The Viral Narrative

The controversy stemmed from the sweeping tax reform signed by President Bola Tinubu in June 2025. Four new bills were enacted as part of a major overhaul of Nigeria’s revenue system, following recommendations by the Presidential Fiscal Policy and Tax Reforms Committee, chaired by Taiwo Oyedele. Social media users seized on one specific section of the reform package Section 159 of the new act which refers to a 5% surcharge on fossil fuels. Posts quickly claimed this meant that Nigerians would automatically begin paying the levy from January 2026, when the broader reform package officially takes effect.

The framing was straightforward and sensational: after subsidy removals had already caused a surge in fuel prices in 2023, Nigerians were now facing another sharp financial burden in the form of a new tax. Several viral posts even described it as a “hidden trap” in Tinubu’s reform agenda. Yet this reading was both legally and factually flawed.

What the Law Actually Says

To understand the confusion, it is crucial to revisit the history of this surcharge. The Federal Roads Maintenance Agency (FERMA) Amendment Act of 2007 already included a provision for a 5% fuel levy to support road maintenance. However, despite being part of the law for nearly two decades, the levy was never implemented in practice. For years, it remained dormant, existing only on paper but never applied at the petrol pump.

The new 2025 Tax Act incorporates this provision as part of a harmonisation effort, pulling together scattered tax clauses into a single framework. In other words, the 5% surcharge was not “invented” in 2025, but rather carried forward from an older statute.

Crucially, both Finance Minister Wale Edun and committee chairman Taiwo Oyedele have publicly confirmed that no commencement order has been issued to activate this provision. Without such an executive order, the clause remains inactive, regardless of its presence in the law.

Official Clarifications

Recognising the spread of disinformation, both government officials moved quickly to set the record straight. Taiwo Oyedele explained in multiple interviews that the fuel surcharge was not a new policy and that it would not take effect in January 2026. He stressed that the inclusion was a matter of legislative harmonisation, not enforcement.

Similarly, Finance Minister Wale Edun told reporters on September 10, 2025, that “no commencement order has been issued or prepared.” He emphasised that while Nigeria is indeed pursuing aggressive fiscal reforms to increase revenue, there is no plan to suddenly impose a petrol surcharge at the start of 2026.

Their clarifications make it abundantly clear: while the provision exists on paper, it will not burden Nigerians in the new year.

Why the Claim Spread

Misinformation thrives where there is public anxiety, and in Nigeria, few issues spark stronger reactions than the price of petrol. The 2023 subsidy removal had already led to significant hardship for ordinary citizens, with fuel costs rising steeply and transportation prices following suit. Against this backdrop, the mere suggestion of an additional 5% tax was enough to ignite anger, panic, and political commentary.

Disinformation actors exploited this context by presenting the technical legal clause as an imminent policy change. The framing was emotionally charged: Nigerians were told they were being tricked, that another financial burden was secretly scheduled for January, and that officials were hiding the truth. Even though credible media outlets did not report such a tax, the virality of short, misleading captions made the claim spread faster than corrections.

Why This Matters

The petrol tax hoax is more than a one-off rumor. It highlights the dangers of misinformation in economic policy, particularly in an era where governments are restructuring fiscal systems under public pressure. In a democracy, economic reform depends on trust. When false claims dominate the conversation, they undermine citizens’ confidence in official communication and fuel resentment.

Moreover, the episode demonstrates the need for greater information transparency from governments. While Oyedele and Edun issued clarifications, the initial silence around the technical details of the 2025 Tax Act created a vacuum that disinformation actors quickly filled. Proactive communication is vital in preventing rumors from taking root.

CyberPoe Final Word

The viral claim that Nigerians will begin paying a 5% fuel surcharge from January 2026 is misleading. The clause exists in law, but it is neither new nor activated. Without a commencement order, Nigerians will not face an additional fuel tax in the new year.

This episode underscores the importance of fact-checking in the age of viral disinformation. Rumors built on half-truths can quickly spiral into widespread outrage, distorting public debate and damaging trust in institutions. As Nigeria prepares to roll out one of the most ambitious tax reforms in its modern history, the battle against economic misinformation will be as important as the reforms themselves.

CyberPoe | The Anti-Propaganda Frontline 🌍